In recent years, the shift towards a cashless economy has gained momentum. The convenience of digital payments has made them popular. However, this system also brings significant disadvantages. In this article, we will explore the drawbacks of a cashless society.

1. Exclusion of Unbanked Individuals

One major disadvantage is that it excludes unbanked individuals. These are people without access to banking services. Cashless systems rely on bank accounts and credit cards. Those who don't have these may feel left out.

2. Dependence on Technology

Being cashless means depending on technology. This includes networks, devices, and power. If any of these fail, buying and selling become difficult.

3. Privacy Concerns

Cashless transactions can be tracked. This means there is less privacy for users. Companies and governments can see what people buy or sell.

4. Increased Risk of Fraud and Hacking

With all data online, there’s a higher risk of fraud and hacking. Cybercriminals can steal information. They can also take money from digital accounts.

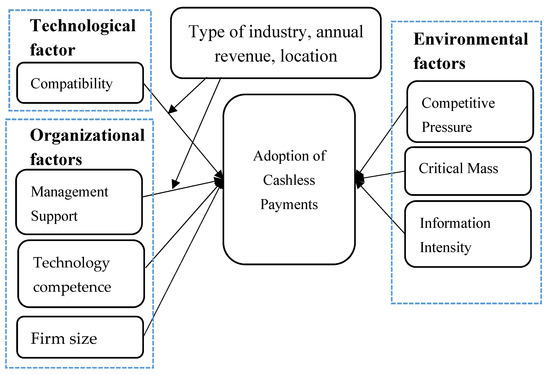

Credit: www.mdpi.com

5. Additional Costs and Fees

Using digital payment methods can have extra costs. Banks and companies may charge fees for their services. This could even be for simple transactions.

6. Impact on Small Businesses

Small businesses may struggle with the switch to cashless. They need to pay for digital payment systems. This cost is hard for some to afford.

7. Overspending

Without physical cash, it’s easier to overspend. People might not realize how much they spend when using cards or apps.

8. Technical Issues and Errors

Technical glitches can cause payment errors. Sometimes, these problems can take time to fix.

Credit: www.linkedin.com

9. No Anonymous Transactions

Cash allows for anonymous purchases. In a cashless society, every transaction has a digital record. There is no anonymity.

| Advantages | Disadvantages |

|---|---|

| Convenience | Exclusion of Unbanked Individuals |

| Speed of Transactions | Dependence on Technology |

| Improved Security | Privacy Concerns |

| Reduced Transaction Costs | Increased Risk of Fraud and Hacking |

| Ease of Access | Additional Costs and Fees |

| Enhanced Tracking of Expenses | Impact on Small Businesses |

Frequently Asked Questions On What Are The Disadvantages Of A Cashless Economy?: Critical Insights

What Are Risks Of A Cashless Society?

A cashless economy can lead to increased risk of cyber-attacks, fraud, and financial data breaches, leaving individuals' financial information vulnerable.

Can Cashless Transactions Exclude Some Groups?

Yes, a cashless economy can marginalize those without access to digital banking, including the elderly, the poor, or residents in remote areas.

How Does Going Cashless Affect Privacy?

Cashless payments can compromise privacy by tracking and recording individuals' spending habits and personal information, potentially exposing them to unwanted scrutiny.

Is A Cashless Economy More Expensive For Merchants?

Merchants may face higher costs in a cashless society due to transaction fees for card payments and the need to maintain digital payment systems.

Conclusion

The cashless economy has many benefits, but also several disadvantages that we need to consider. As we move forward, it's important to address these concerns. We should ensure a fair and secure financial system for all.

0 Comments

Hi,Friend

Thanks a lot of our comments...